Understanding your Financial Aid Offer

Your financial aid offer is a document detailing the types of financial aid you are eligible to receive, helping you understand the resources available to cover your educational costs. Offers are typically made available to all students beginning in late March. You will receive an email when your financial aid offer is ready to view in MyUI. If you are an incoming first-year or transfer undergraduate student, you will also receive a physical copy of the financial aid offer in the mail.

Understanding your financial aid offer is just one part of planning for your educational expenses. It’s important to review how your aid applies to your University Bill and explore payment options to ensure a smooth financial experience. Visit Understanding Financial Aid and the Billing Process to learn more.

Understanding the Financial Aid Offer Using the Sample Below

The images below are from a sample financial aid offer and use hypothetical dollar amounts for illustrative purposes.

Your actual financial aid offer will look similar but may contain different amounts based on your individual eligibility. To view your personalized financial aid offer once it is made available to you each year, log in to MyUI.

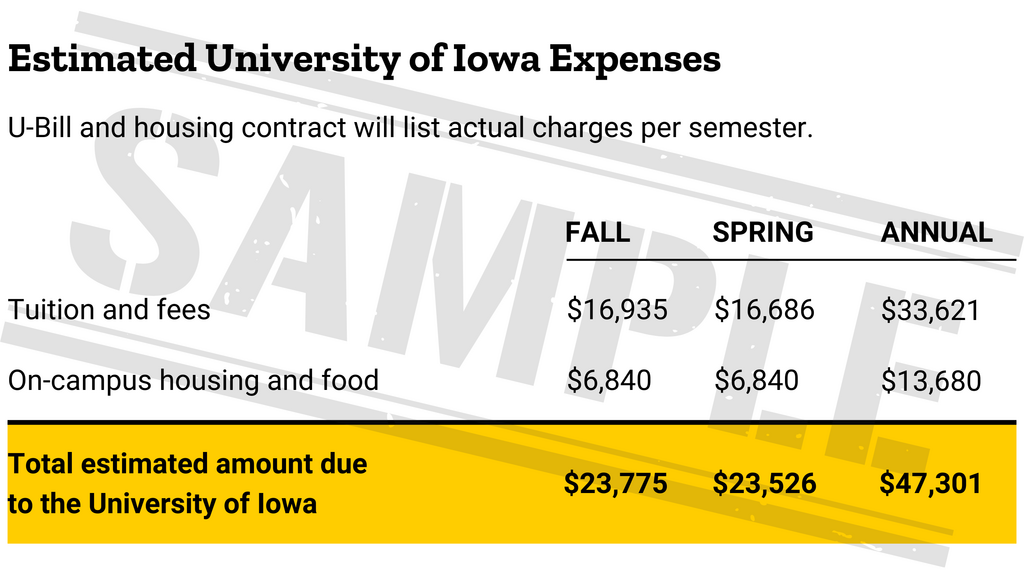

Estimated University of Iowa Expenses

The Tuition and Fees listed is estimated and is finalized each summer for the following school year by the State of Iowa Board of Regents. Tuition varies for students depending on the program of study and the number of enrolled semester hours. View detailed tuition and fee information from the Registrar's Office.

On-Campus Housing and Food is also estimated. Actual housing and food costs will vary by student depending on what housing and meal plan is chosen during housing selection in June. View room rates and billing information from University Housing & Dining.

The August and January U-Bill will list actual Tuition & Fees and Housing & Food charges.

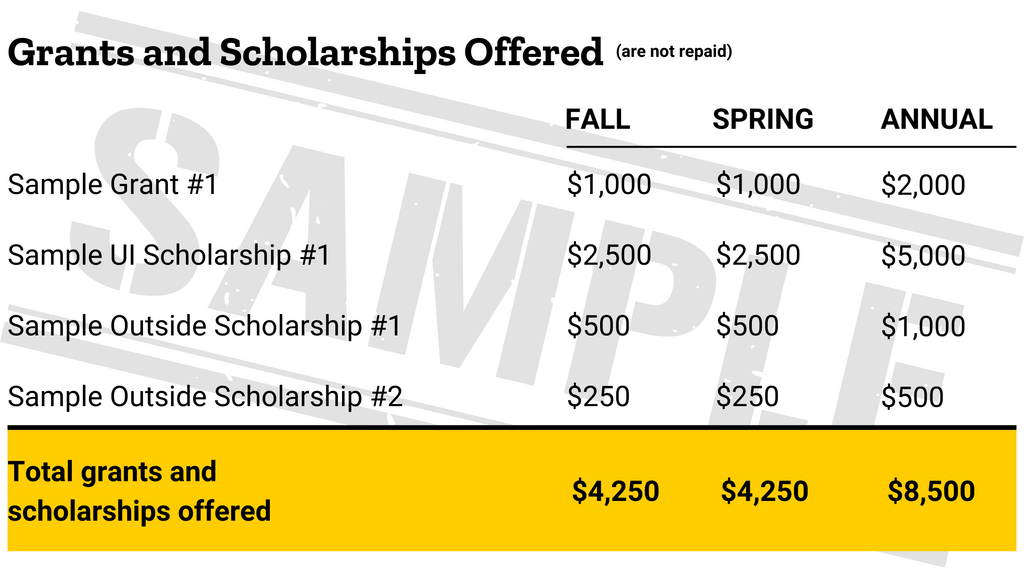

Grants & Scholarships Offered

Need-based grants and scholarships are based on your cost of attendance, student aid index (SAI) as determined by your FAFSA, and other financial assistance. Any future grants, scholarships, or financial aid you receive may cause reductions to your need-based grants and scholarships. Log in to MyUI to review the renewal requirements of your grant(s) or scholarship(s).

Merit-based scholarships recognize academic achievement and other accomplishments. Some may require financial need and cannot exceed the cost of attendance. Log in to MyUI to review the renewal requirements of your scholarship(s). You can also pursue scholarships through private donors, foundations, businesses, or other sources. For future years, please refer to the Iowa Scholarship Portal for additional scholarship opportunities.

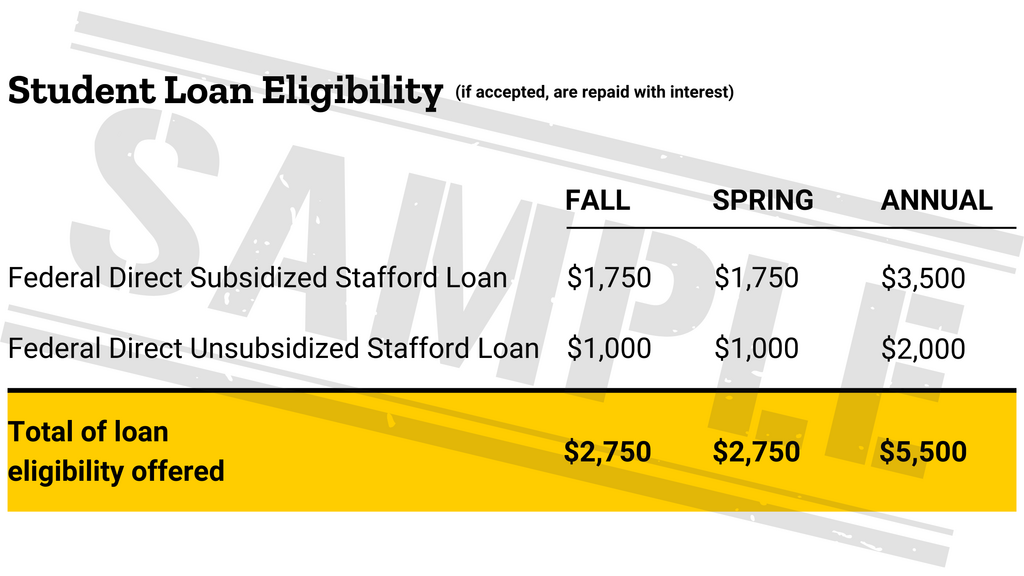

Student Loan Eligibility

Federal Direct Subsidized Loans are based on financial need, as determined by your FAFSA. No interest will accrue on the loan while you are enrolled in school at least half-time. The U.S. Department of Education will subtract a small loan fee before the loan is disbursed.

Federal Direct Unsubsidized Loans do not require financial need. Interest will accrue on the loan while you are enrolled in school. The U.S. Department of Education will subtract a small loan fee before the loan is disbursed.

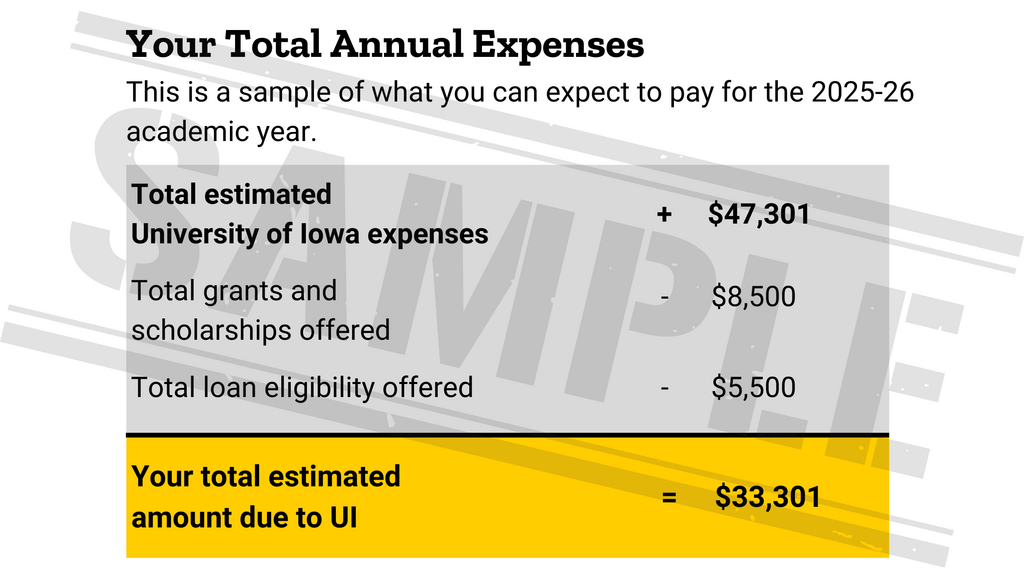

Your Total Annual Expenses

This is what you can expect to pay towards your University Bill (U-Bill) for the full academic year. You will be billed for the fall semester on the August U-Bill and for the spring semester on the January U-Bill.

Your total estimated amount due to the University of Iowa equals your total estimated expenses minus any grants and scholarships offered, as well as any loans offered. If you choose not to accept or use the offered loans, your U-Bill payment will increase accordingly.

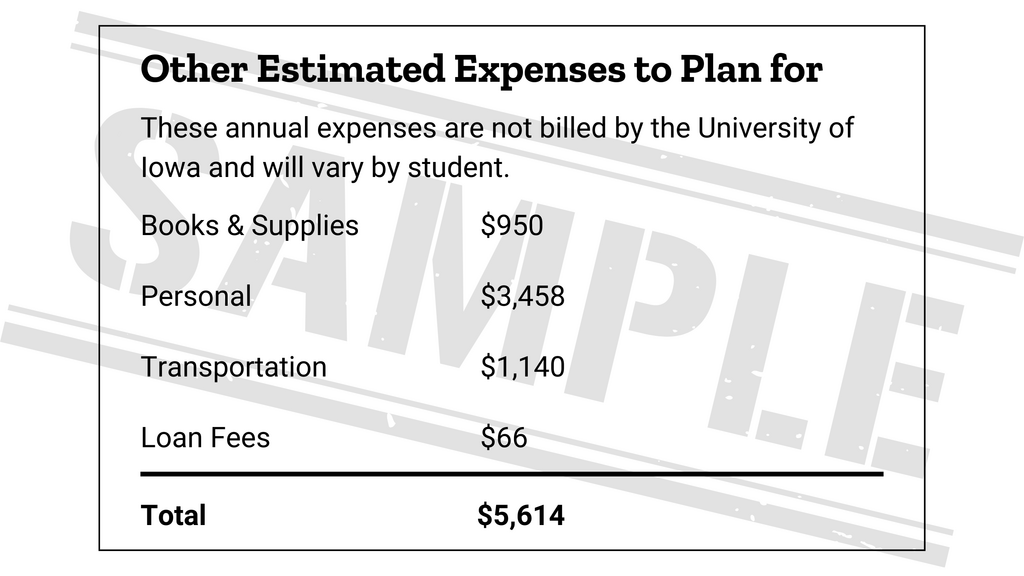

Other Estimated Expenses to Plan For

Other estimated expenses you may have that are not charged to your U-Bill can include:

- Off-campus housing and food - the average cost of rent, utilities, and food for the Iowa City/Coralville area.

- Books, course materials, supplies, and equipment - an allowance for books, course materials, and equipment, which includes all such costs required of all students in the same course of study, including a reasonable allowance for the rental or upfront purchase of a personal computer.

- Personal Expenses - includes, but is not limited to, clothing, personal items, entertainment, etc.

- Transportation - travel to and from classes, places of work, and trips home during breaks.

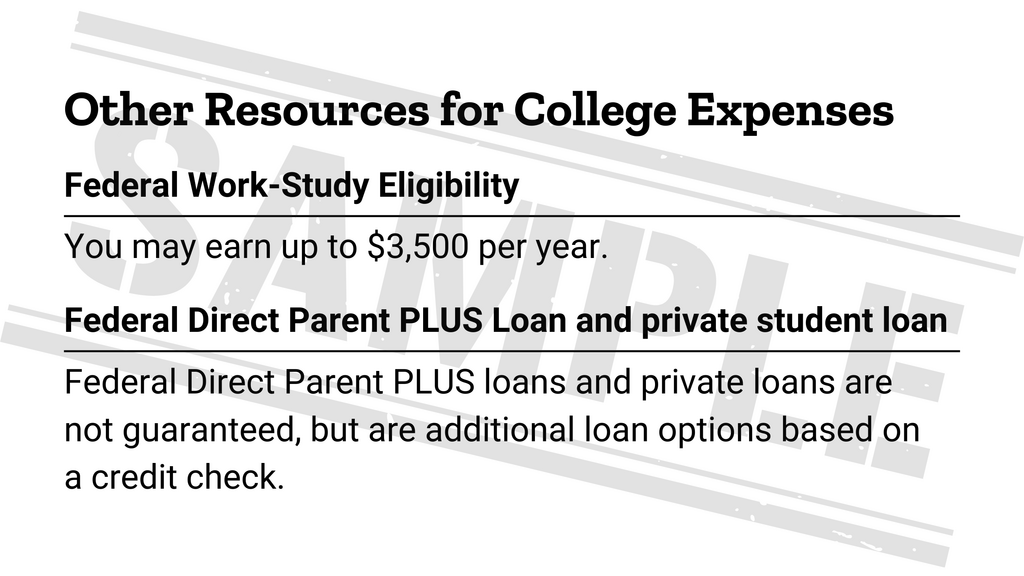

Other Resources for College Expenses

Federal Work-Study

Work-Study is based on financial need, as determined by your FAFSA, and allows you to apply for and secure a part-time job that pays you every two weeks. Work-Study earnings do not get applied to your U-Bill.

Parent Loans

Starting in April, either parent may apply for a Parent PLUS loan. The Parent PLUS loan requires separate applications for fall and spring semesters. Credit approval is required for PLUS loans.

Private Loans

Private student loans are available from a variety of lenders. If you borrow a private loan, you are required to complete private loan counseling with a Financial Aid Advisor. To avoid delays, complete private loan counseling before August 1. Note that credit approval is required, and a co-signer is often necessary for student borrowers. Private lenders also offer parent loans. No private loan counseling will be required for parent private loans.

Next Steps

Once you receive your financial aid offer, you may have additional next steps. Complete the following if it pertains to you:

Complete Loan Requirements

- Direct Loan borrowers are required to complete Entrance Counseling and Master Promissory Note (MPN)

- Accept, reduce, or decline your Direct Loan(s) for each semester in MyUI

Complete Missing Documents

- Check your Financial Aid To Do List in MyUI for any documents that may be missing, such as Verification

- Only submit the information that has been requested

Report Outside Scholarships

- If you receive any additional funds from outside sources, such as scholarships that were not included in your financial aid offer, this must be reported to our office via MyUI

- We will adjust your financial aid offer accordingly

Possible Impacts to Financial Aid Offer

Changes in Year-to-Year FAFSA Results

Year-to-year changes in the FAFSA can affect your aid offer because they impact the information used to determine your eligibility for financial aid. Changes in your or your family's income, assets, and household size, as well as changes in federal and state financial aid policies, can all influence your aid offer from one year to the next. It's essential to stay informed about FAFSA updates and to reapply for financial aid each year to reflect your current financial circumstances accurately.

Dropping or Adding Courses

Your financial aid offer amount is determined by the number of credit hours you are taking. Initially, your offer is based on full-time, full-year enrollment. However, if you are taking less than 12 credit hours or do not plan to return for the spring semester, your offer will be adjusted accordingly. If you are considering dropping below full-time enrollment or withdrawing from the semester, we advise you to contact the Office of Student Financial Aid to discuss how your plans may impact your future grant and/or scholarship eligibility, as well as loan repayment requirements. Remember, it is your responsibility to inform us of any changes in the number of credit hours you are taking.

Impact of UI's Census Date, the 10th Day of Each Semester

If, on the 10th day of the semester, your actual enrollment hours are different from the hours on which your financial aid was based, your financial aid may be recalculated. To be considered a full-time student, you must remain enrolled for at least twelve hours as an undergraduate or professional student and nine hours as a School of Management or graduate student.

Additional Outside Scholarships

If you receive any additional funds from outside sources such as scholarships that were not included in your financial aid offer, this must be reported to the Financial Aid office. This is mandatory per federal regulations. If the amount of funding from the outside source changes from what is listed on your offer, please contact the Financial Aid office immediately. We will adjust your offer accordingly.

Graduating in the Fall Semester

For undergraduate students planning to graduate in December, loan proration is a requirement that you should know about. This means is that we'll have to reduce the number of weeks used to determine your cost of attendance. This reduction may impact the amount of federal loans you are eligible to receive for the Fall Semester.

Changes to Your Financial Circumstances or Expenses

Our office recognizes that families may experience changes or have additional expenses that are not reflected on the FAFSA. This could affect your family's ability to contribute to your college education and/or could increase your estimated cost of attendance. The U.S. Department of Education regulations allow financial aid offices to determine which circumstances warrant further review. To ensure fairness and compliance with the federal financial aid regulations, special and/or unusual circumstances may be considered on a case-by-case basis with limitations as to what can be considered. Learn more at Changes in Financial Circumstances and Cost of Attendance Adjustments for Additional Expenses.

Official Aid Offer Information

The University of Iowa is committed to using the Principles Standards of the College Cost Transparency Initiative in its student financial aid offer.